Get the free aps com assist

Show details

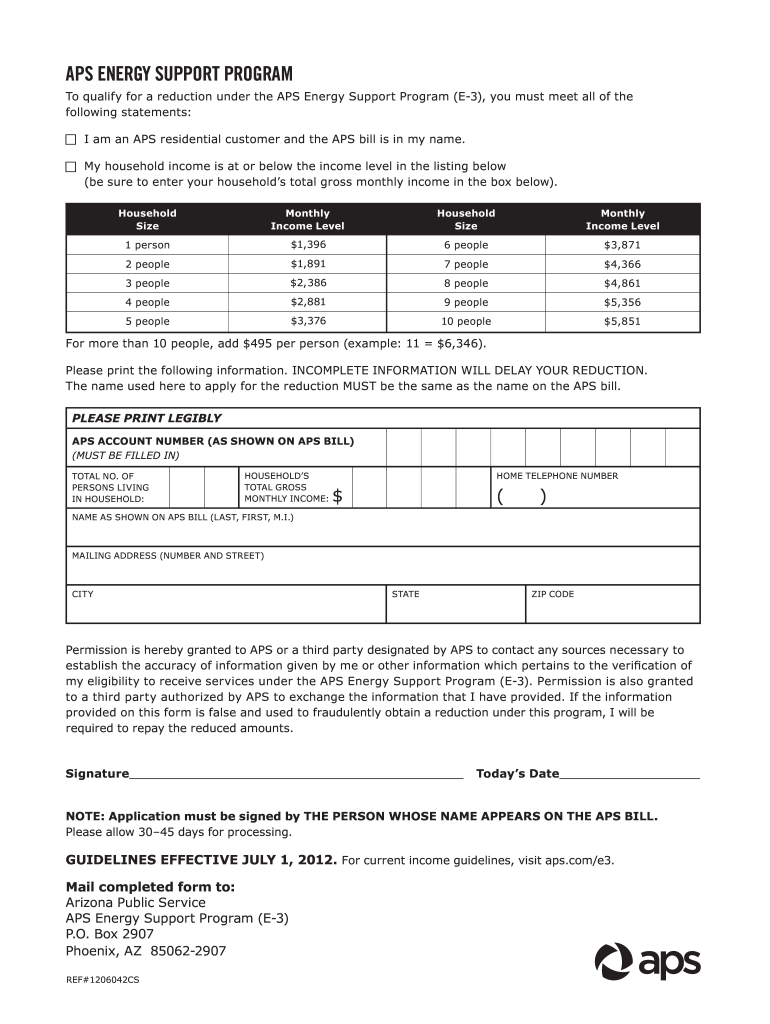

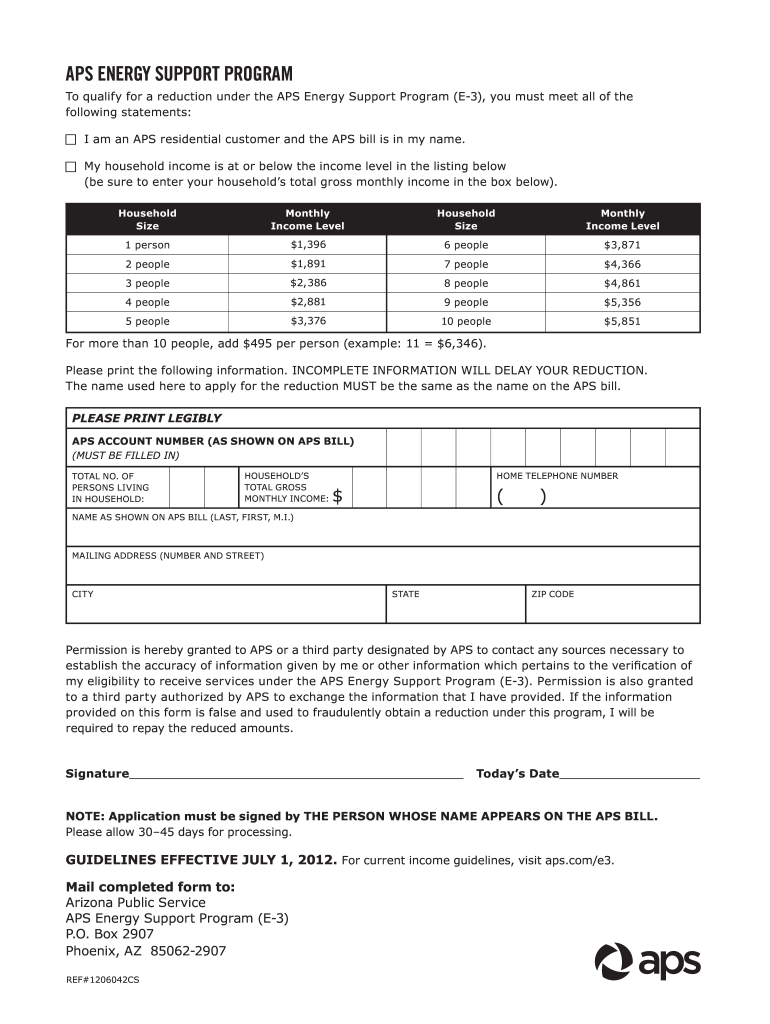

For current income guidelines visit aps. com/e3. Mail completed form to Arizona Public Service APS Energy Support Program E-3 P. APS ENERGY SUPPORT PROGRAM To qualify for a reduction under the APS Energy Support Program E-3 you must meet all of the following statements I am an APS residential customer and the APS bill is in my name. My household income is at or below the income level in the listing below be sure to enter your household s total gross monthly income in the box below. OF PERSONS...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aps low income application form

Edit your aps assist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aps application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aps energy support application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit aps low income application online form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aps energy support program form

How to fill out APS E-3

01

Gather necessary personal documents: passport, visa, and employment details.

02

Download the APS E-3 form from the official website.

03

Fill in your personal information accurately in the designated fields.

04

Specify the position and employer details in the relevant sections.

05

Provide your qualifications and experience as required.

06

Double-check all information for accuracy.

07

Submit the completed form along with any required documents to the appropriate authority.

Who needs APS E-3?

01

Individuals applying for an E-3 visa to work in the United States in specialty occupations.

02

Employers sponsoring foreign workers for E-3 visas.

Fill

aps 25 discount

: Try Risk Free

People Also Ask about aps e3 program

Should I pay my taxes in full or payment plan?

More In Help There's also a penalty for failure to file a tax return, so you should file timely even if you can't pay your balance in full. It's always in your best interest to pay in full as soon as you can to minimize the additional charges.

What is the IRS payment plan tax rate?

If you've found yourself facing an overwhelming tax bill, you may need to set up a payment plan with the IRS. Currently the IRS payment plan interest rate is 0.25% per month (equal to an annual rate of 3%).

How much is IRS penalty for payment plan?

If you don't pay the amount shown as tax you owe on your return, we calculate the Failure to Pay Penalty in this way: The Failure to Pay Penalty is 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid. The penalty won't exceed 25% of your unpaid taxes.

What is the penalty rate for IRS payment plan?

The failure-to-pay penalty is one-half of one percent for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

What happens to my tax return if I have a payment plan?

Can I receive a tax refund if I am currently making payments under an installment agreement or payment plan for another federal tax period? No, one of the conditions of your installment agreement is that the IRS will automatically apply any refund (or overpayment) due to you against taxes you owe.

Does IRS payment plan reduce penalties?

Though interest and late-payment penalties continue to accrue on any unpaid taxes, the failure to pay tax penalty rate is cut in half while an installment agreement is in effect. The usual penalty rate of 0.5 percent per month is reduced to 0.25 percent.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit aps discount form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your aps payment into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my aps low income energy assistance in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your aps energy support program application right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out plan payment tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign energy support on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is APS E-3?

APS E-3 is a specific form used for reporting certain information related to withholdings and expenditures by employers and employees in relation to the APS (Automatic Payment System).

Who is required to file APS E-3?

Employers who have employees that are subject to withholding requirements for wages and certain payments are required to file APS E-3.

How to fill out APS E-3?

To fill out APS E-3, employers must provide accurate information regarding employee details, withholding amounts, and payment timelines according to the instructions provided with the form.

What is the purpose of APS E-3?

The purpose of APS E-3 is to ensure compliance with tax withholding regulations and to report the necessary information to the relevant tax authorities.

What information must be reported on APS E-3?

Information that must be reported on APS E-3 includes employee names, identification numbers, gross wages, withholding amounts, and any other relevant payment details.

Fill out your APS E-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aps Discount Program is not the form you're looking for?Search for another form here.

Keywords relevant to aps support

Related to aps assistance low income

If you believe that this page should be taken down, please follow our DMCA take down process

here

.