Get the free aps com assist form

Show details

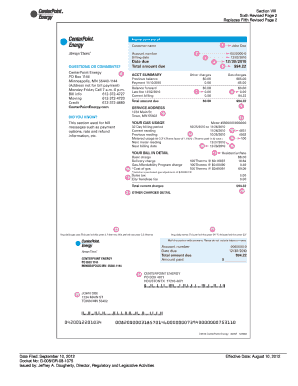

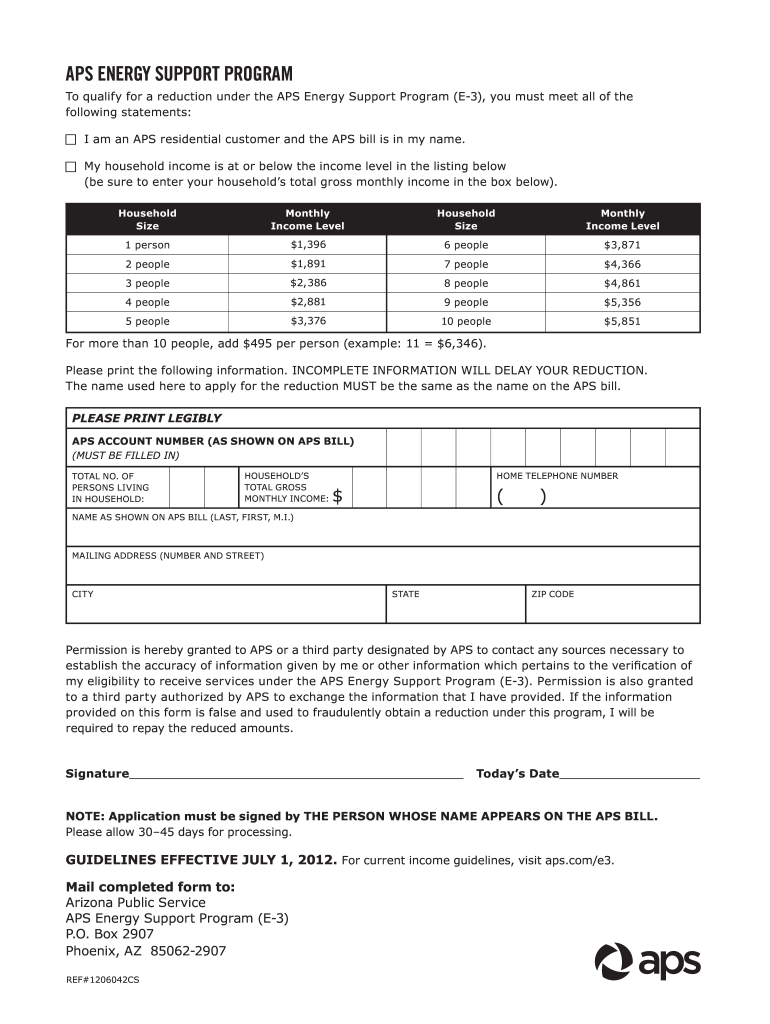

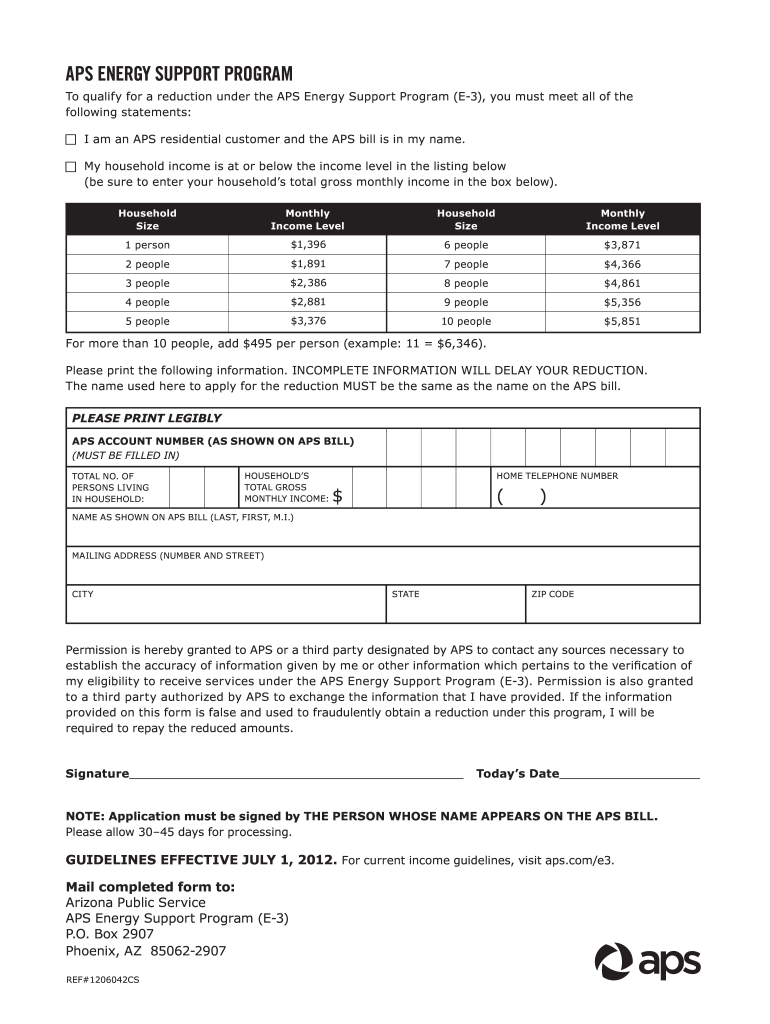

For current income guidelines visit aps. com/e3. Mail completed form to Arizona Public Service APS Energy Support Program E-3 P. APS ENERGY SUPPORT PROGRAM To qualify for a reduction under the APS Energy Support Program E-3 you must meet all of the following statements I am an APS residential customer and the APS bill is in my name. My household income is at or below the income level in the listing below be sure to enter your household s total gross monthly income in the box below. OF PERSONS...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your aps com assist form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aps com assist form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aps com assist online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit aps payment form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out aps com assist form

How to fill out aps payment?

01

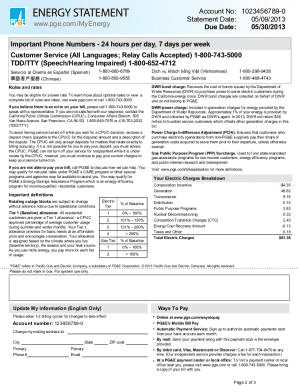

Ensure that you have all the necessary documents and information ready, including your name, address, social security number, and payment details.

02

Visit the APS payment website or platform and navigate to the payment section.

03

Select the option to make a payment and choose APS payment as the preferred method.

04

Provide the required details, including the amount you wish to pay and your payment method (credit card, bank transfer, etc.).

05

Double-check all the entered information for accuracy and completeness.

06

Submit your payment and wait for the confirmation message or receipt.

Who needs aps payment?

01

Anyone who is a customer of APS (Arizona Public Service), the primary electric utility serving Arizona, may require APS payment services.

02

APS payment is especially relevant for residential customers who need to pay their monthly electricity bills.

03

Businesses and commercial establishments that receive services from APS may also need to make payments through APS payment channels.

Fill aps assist : Try Risk Free

People Also Ask about aps com assist

Should I pay my taxes in full or payment plan?

What is the IRS payment plan tax rate?

How much is IRS penalty for payment plan?

What is the penalty rate for IRS payment plan?

What happens to my tax return if I have a payment plan?

Does IRS payment plan reduce penalties?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file plan payment tax?

Any individual who is subject to the income tax under the Internal Revenue Code and who has an unpaid tax liability must file a plan payment tax return. This includes self-employed individuals, sole proprietors, and independent contractors.

What information must be reported on plan payment tax?

Plan payment tax must include the income amount received, the taxes withheld, and the payer's name and address. Additionally, any other details related to the plan payments, such as the type of plan, must also be reported.

When is the deadline to file plan payment tax in 2023?

The deadline to file plan payment taxes in 2023 is April 15, 2024.

What is the penalty for the late filing of plan payment tax?

If you fail to file your plan payment tax return by the due date, you may be subject to a penalty equal to 5% of the amount of unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. In addition, you may be subject to a minimum penalty of the lesser of $135 or 100% of the unpaid tax.

What is plan payment tax?

"Plan payment tax" is not a standard financial term or concept. It is possible that you might be referring to different taxes related to payment plans for taxes. Here are a few possible interpretations:

1. Tax Installment Payment Plans: Some tax authorities may allow taxpayers to pay their owed taxes in installments or through a payment plan. This helps individuals or businesses manage their tax liabilities by spreading the payments over a specific period. In this case, "plan payment tax" could refer to the tax payment made under such a tax installment plan.

2. Tax on Payments for Services: When individuals or businesses receive payments for services rendered, they may be subject to income tax on those earnings. It is possible that "plan payment tax" refers to the taxes owed on payments received for services provided as part of a structured payment plan.

3. Withholding Taxes on Payment Plans: In some cases, when individuals or businesses enter into payment plans with vendors or service providers, a certain percentage of payments may be withheld as taxes. This withholding is typically done to ensure that the tax obligations of the vendor or service provider are met. Therefore, "plan payment tax" could indicate the taxes withheld from the payments made as part of a payment plan.

4. Employee Benefit Plans: Employee benefit plans, such as retirement plans (e.g., 401(k)) or health plans, may have tax implications for both employers and employees. "Plan payment tax" could potentially refer to taxes associated with contributions or payments made towards such employee benefit plans.

It is essential to clarify the specific context or provide additional information for a more accurate answer.

How to fill out plan payment tax?

To fill out a payment plan request form for your taxes, follow these steps:

1. Obtain the correct form: The Internal Revenue Service (IRS) typically requires you to fill out Form 9465, Installment Agreement Request, to apply for a payment plan. You can download the form from the IRS website or request a copy by calling the IRS helpline.

2. Provide personal information: Fill in your personal details such as name, address, Social Security number, and contact information in the designated sections of the form.

3. Specify tax liabilities: Indicate the type of tax you owe, such as income tax, employment tax, or another type of tax. Enter the tax year and the amount you owe for each tax year you need to include in the payment plan.

4. Proposed payment plan: Decide on the monthly payment amount you can afford to pay to the IRS. Enter this amount in the appropriate section of the form. Ensure the amount is reasonable and realistic for your financial situation.

5. Payment method: Let the IRS know how you plan to make your monthly payments. You can choose between options like direct debit, check/money order, or payroll deduction, depending on what aligns best with your circumstances.

6. Requested installment agreement: Indicate the duration of the payment plan you are seeking. Specify the date you prefer for the monthly payment to be made, such as the first or fifteenth of the month.

7. Attach required documents: If necessary, attach any supporting documentation required by the IRS for your payment plan request. This might include financial statements or proof of income.

8. Sign and date the form: Review the form to ensure you have provided accurate information. Sign and date the completed form in the appropriate section.

9. Submit the form: Send the filled-out form to the IRS address provided on the form. You can choose to mail it or, in some cases, submit it online through the IRS website.

Remember to keep a copy of the completed form for your records. Once the IRS receives your payment plan request, they will review it and inform you of their decision or request any additional information if necessary.

What is the purpose of plan payment tax?

The purpose of a plan payment tax likely refers to a tax that is imposed on payments made towards a certain plan, such as a retirement plan or a payment plan for a large purchase. The specific purpose of this tax may vary depending on the country and its tax laws, but generally, it could serve multiple purposes, including:

1. Revenue generation: The tax may be imposed to generate revenue for the government, which can be used to fund public services and infrastructure.

2. Encouraging savings and investment: By taxing plan payments, the government may aim to encourage individuals to save and invest their money rather than spending it immediately. This can promote long-term financial stability and economic growth.

3. Redistribution of wealth: The tax on plan payments may be part of a progressive tax system designed to redistribute wealth and promote socio-economic equality. It ensures that individuals who have accumulated wealth or have higher incomes contribute a proportionate amount towards public expenditure.

4. Discouraging certain financial behaviors: The tax may be targeted towards specific financial behaviors that the government wants to discourage. For example, a high tax rate on early withdrawals from retirement plans may deter individuals from accessing their retirement funds before reaching a certain age, thus promoting long-term savings.

It is important to note that the purpose and specifics of plan payment tax can vary significantly depending on the jurisdiction and the specific plan being taxed.

How can I edit aps com assist from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your aps payment form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my plan payment tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your aps assistance form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out aps application form using my mobile device?

Use the pdfFiller mobile app to fill out and sign aps low income application form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your aps com assist form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan Payment Tax is not the form you're looking for?Search for another form here.

Keywords relevant to aps e3 program form

Related to aps discount application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.